Vancouver, British Columbia, February 20, 2024 – Kenorland Minerals Ltd. (TSXV: KLD) (OTCQX: KLDCF) (FSE: 3WQ0) (“Kenorland” or the “Company”) is pleased to announce final drill results from the 2023 fall drill program at the Frotet Project (the “Project”), located in northern Quebec. The Company also announces that, further to its press release dated January 16, 2024, it has completed the exchange with Sumitomo Metal Mining Canada Ltd. (“Sumitomo”) of the Company’s 20% participating interest in the Frotet Project for a 4.0% net smelter return royalty (the “Frotet Royalty”) on all minerals extracted from the Project. Assays from the 20 drill holes, totaling 11,918m of drilling completed during the 2023 fall drill program, are reported herein.

Highlights include the following:

- 23RDD185: 19.25m at 19.95 g/t Au incl. 1.90m at 106.48 g/t Au at R6

- 23RDD177: 1.00 m at 174.54 g/t Au incl. 0.30m at 579.30 g/t Au at R1

- 23RDD193: 35.45m at 2.90 g/t Au incl. 1.70m at 15.52 g/t Au at R4

- 23RDD175: 17.65m at 4.59 g/t Au incl. 1.08m at 43.96 g/t Au at R5

- 23RDD177: 11.31m at 6.89 g/t Au incl. 2.12m at 26.37 g/t Au at R5

- 23RDD176: 10.70m at 5.67 g/t Au incl. 2.00m at 14.99 g/t Au at R5

- 23RDD182: 1.00m at 54.40 g/t Au at R2

- 23RDD187: 8.95m at 6.34 g/t Au incl. 1.45m at 20.27 g/t Au at R4

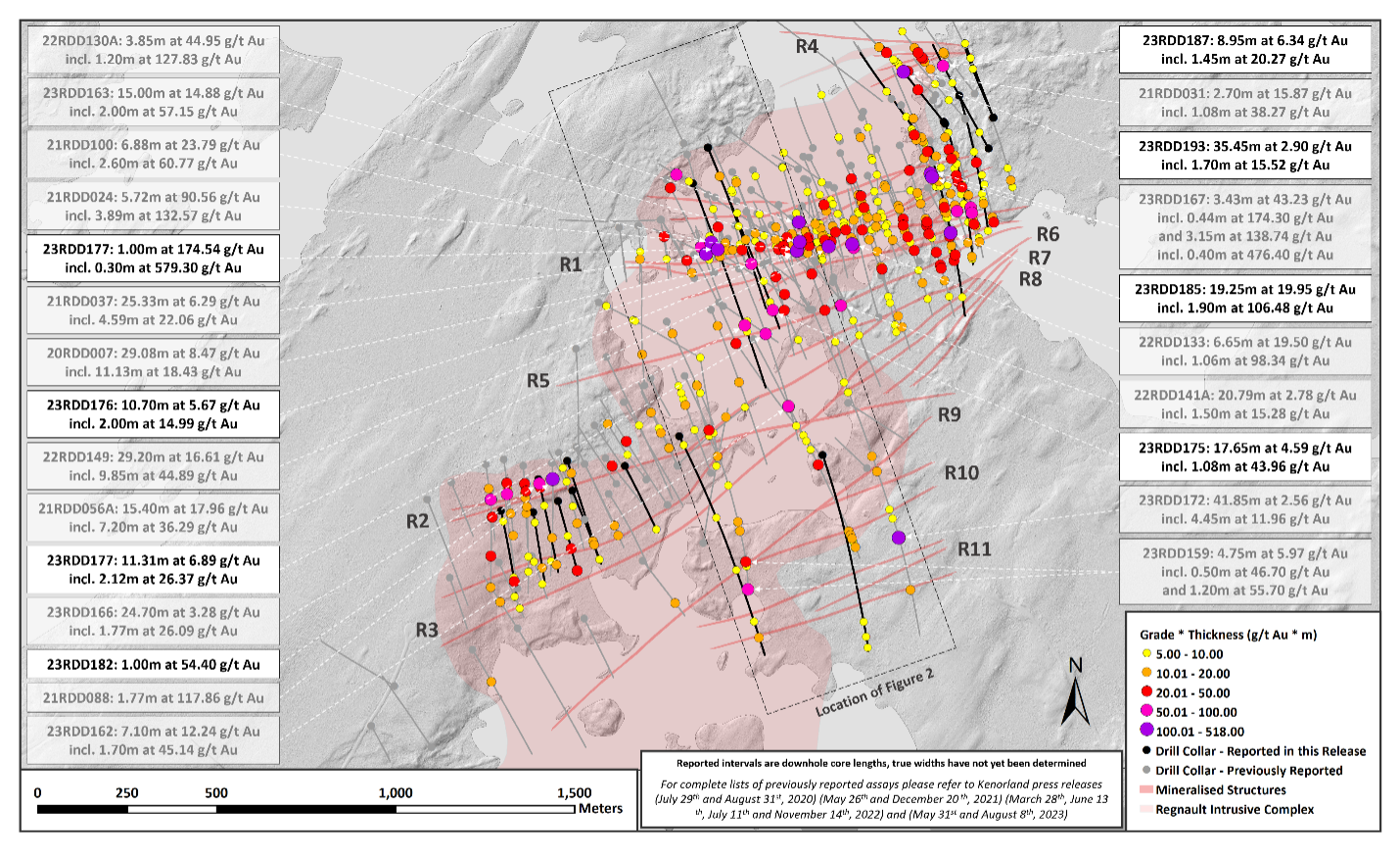

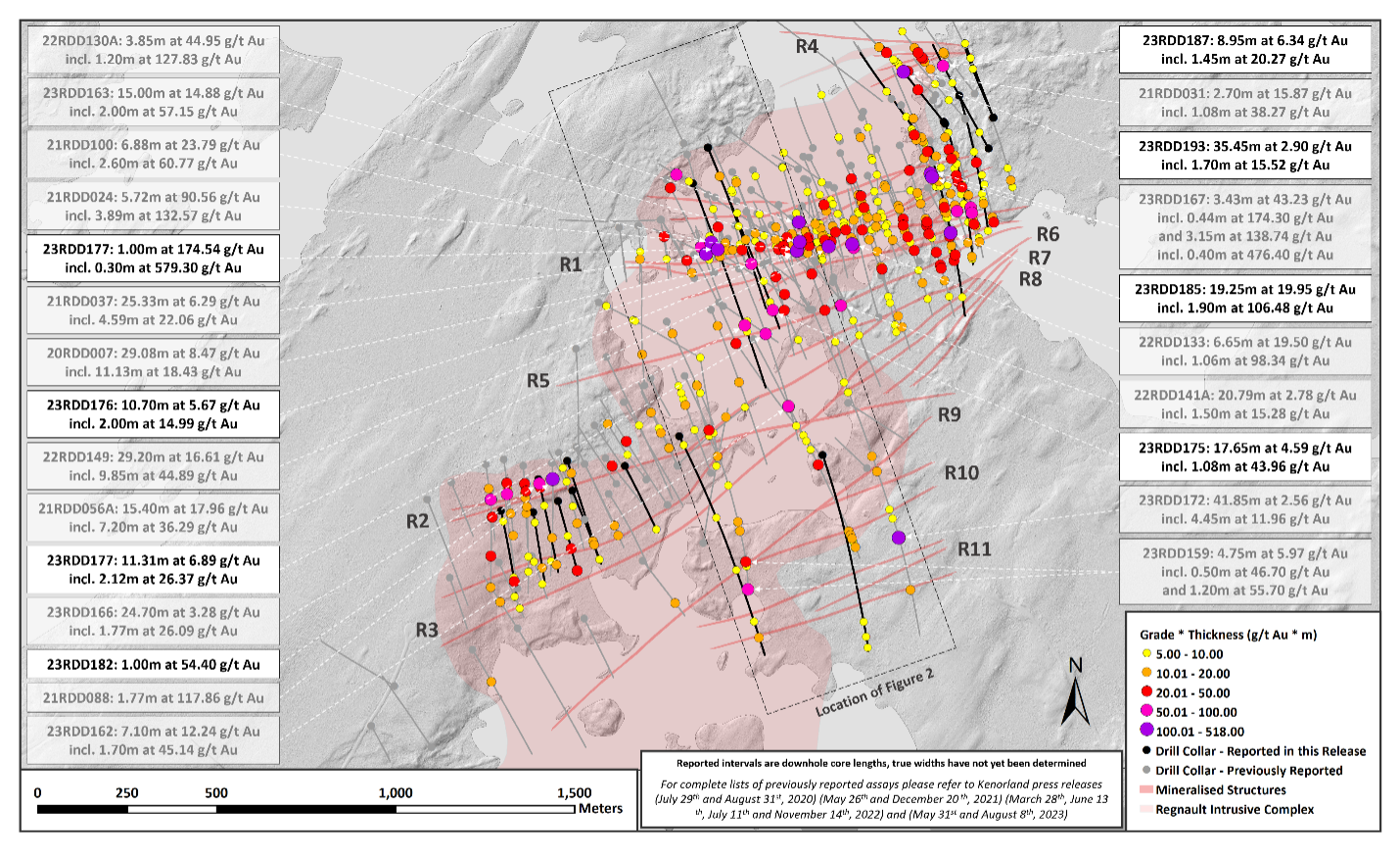

Figure 1. Plan map of Regnault drilling including highlights from this press release

Zach Flood, President and CEO of Kenorland Minerals, states, “The latest results from the fall 2023 drill program continue to demonstrate the exceptional high-grade nature of the Regnault gold deposit. It’s an incredible gold system and we’ve been fortunate to take it from grassroots discovery to the advanced stages of exploration today.”

“In addition, we’re delighted to announce the close of a transaction resulting in Kenorland now owning a 4% NSR royalty on the project, received in exchange for our 20% minority interest in the prior joint venture with Sumitomo Metal Mining. Sumitomo is a well-established, leading global mining and materials company, and we look forward to continuing to work with them closely as we operate the project over the upcoming year.”

Discussion of Results

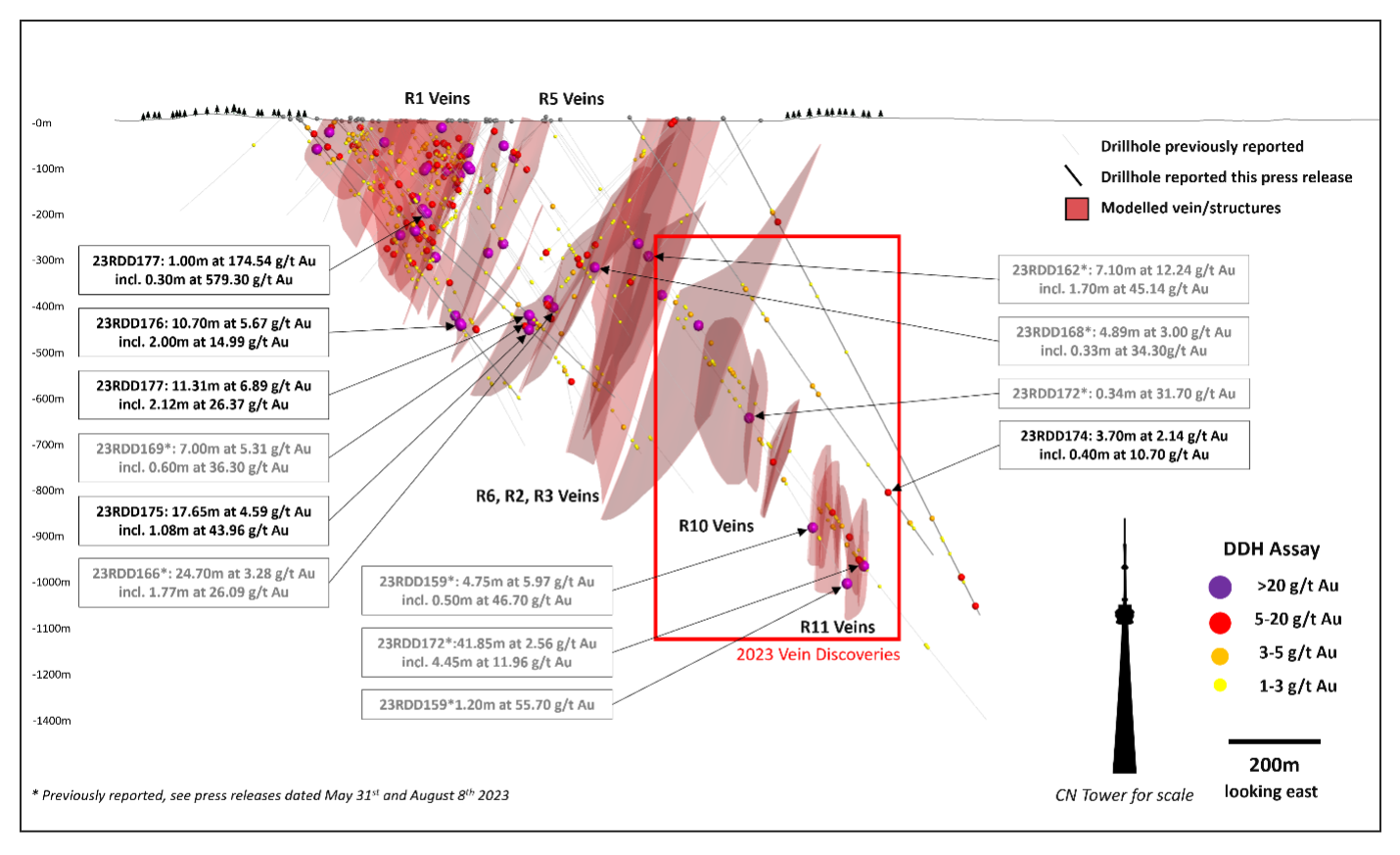

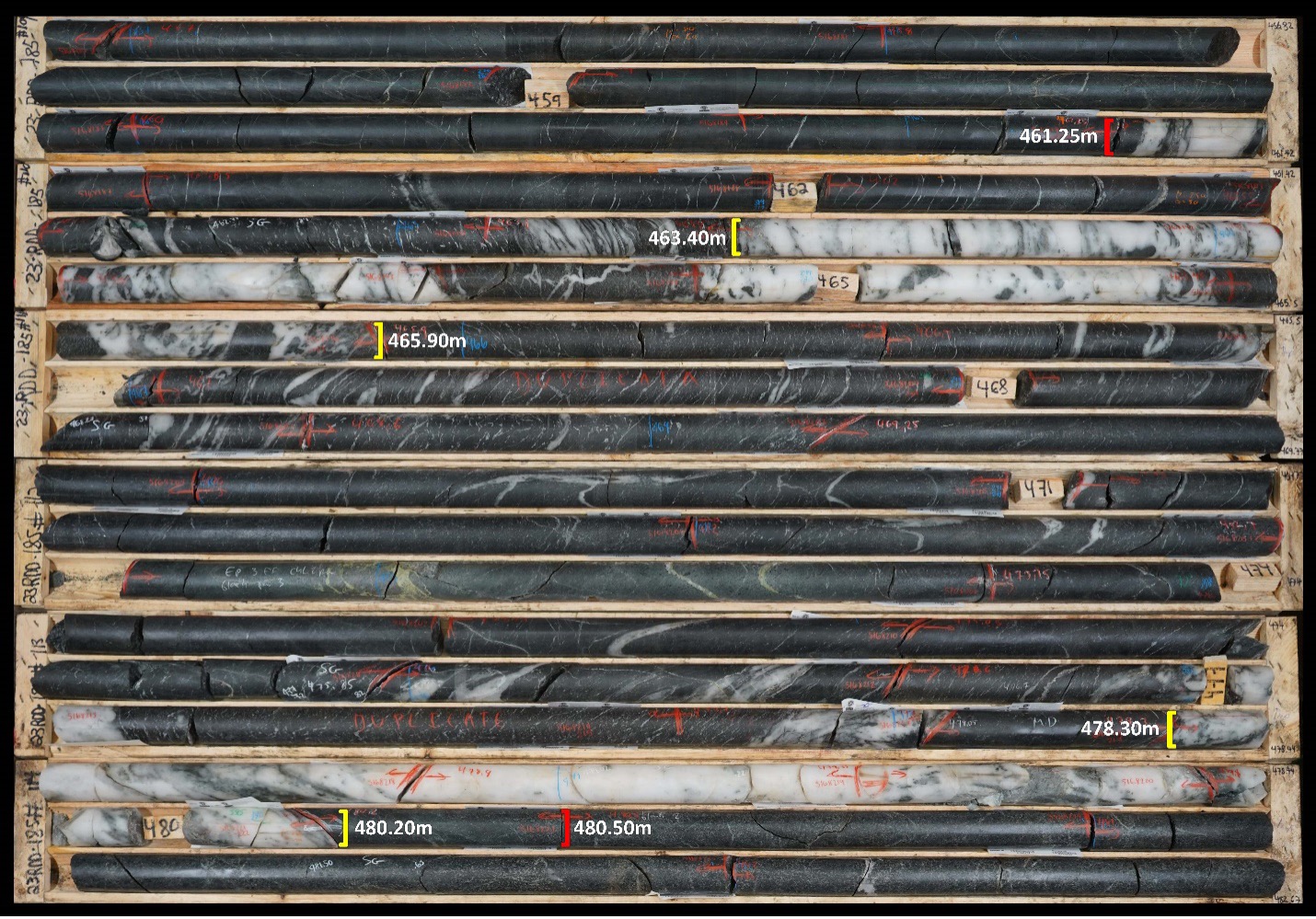

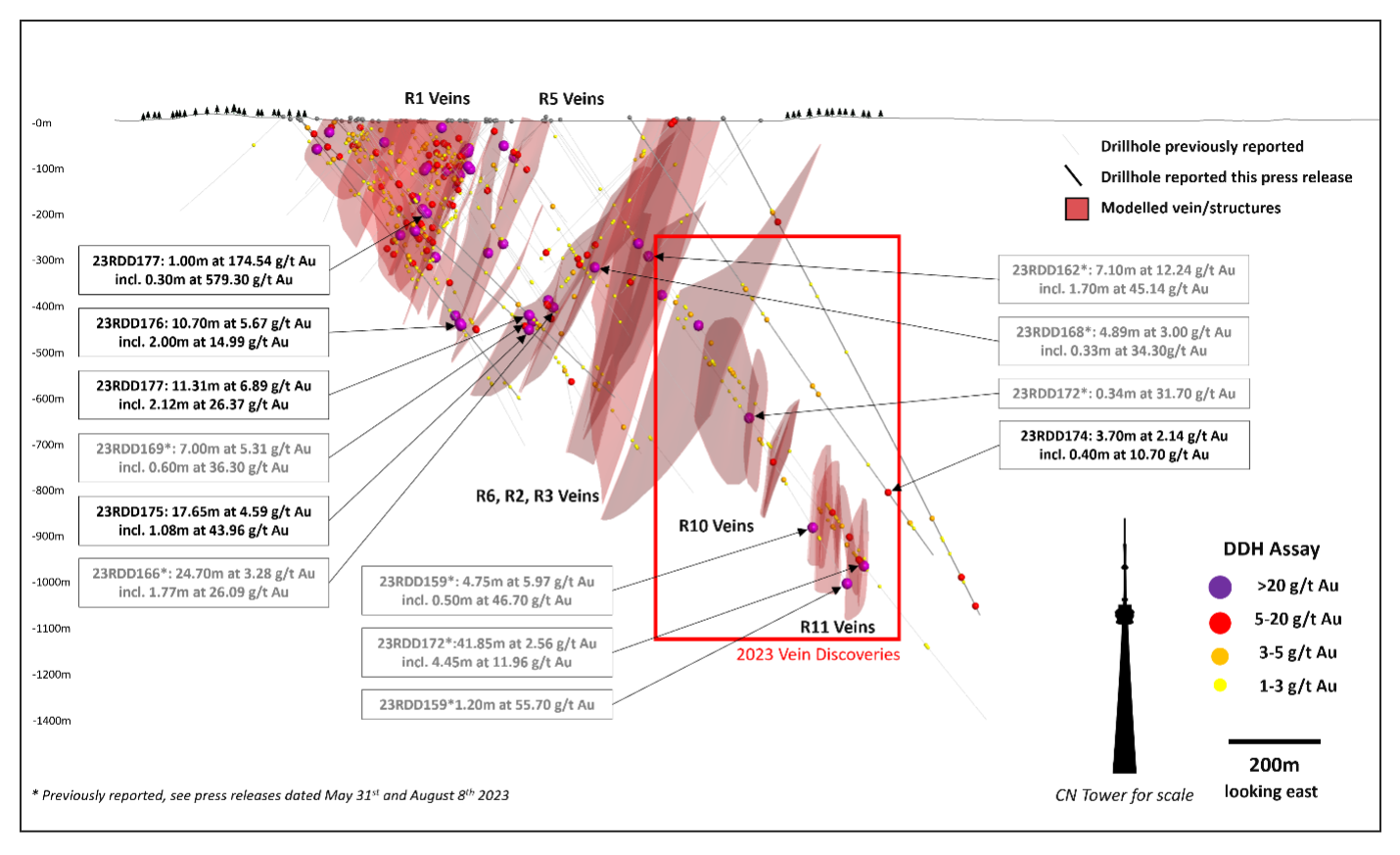

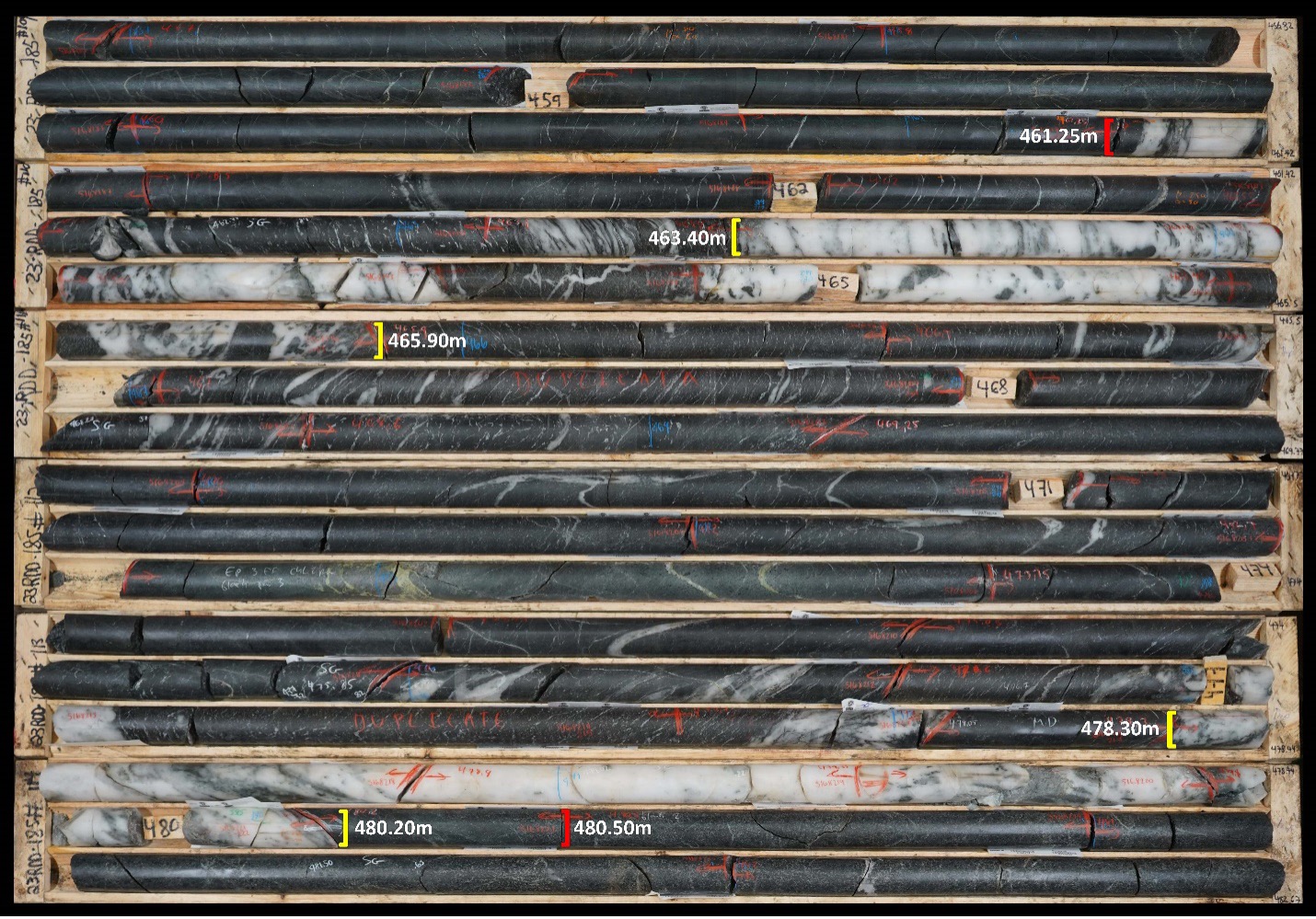

Much of the reported drilling was designed as broad step-outs and infill along known mineralised trends throughout the Regnault deposit. Along the R5, R6, R7 and R8 structural corridors, significant step-out results include 23RDD176 intersecting 10.70m at 5.67 g/t Au including 2.00m at 14.99 g/t Au, 23RDD175 returning 17.65m at 4.59 g/t Au including 1.08m at 43.96 g/t Au, and 23RDD177 returning 11.31m at 6.89 g/t Au including 2.12m at 26.37 g/t Au. These holes successfully extended R5 mineralisation to the west, to 450m vertical depth and remains open. Infill and step-out targets along the eastern portions of the R1, R5, R6, R7 and R8 mineralised structures intersected additional high-grade mineralisation including 23RDD192 with 2.20m at 17.45 g/t Au including 0.30m at 98.50 g/t Au, a step-out at depth along R1. 23RDD185 intersected 19.25m at 19.95 g/t Au including 1.90m at 106.48 g/t Au, infill along R6, located 70m to the west of hole 22RDD144 that returned 10.08m at 4.43 g/t Au including 0.59m at 27.10 g/t Au (see press release dated November 14, 2022). Drilling within this area has extended known mineralisation to greater than 775m vertical depth with 23RDD188 returning 3.40m at 2.72 g/t Au including 0.50m at 12.20 g/t Au along the R8 vein set.

Figure 2. Cross section through the Regnault gold system

Broad step-outs along the R4 vein system extended high-grade mineralisation for a known strike length of 300m and to 300m vertical depth. Significant results include 23RDD193 which intersected 35.45m at 2.90 g/t Au including 1.70m at 15.52 g/t Au, a 70m step-out at depth below 20RDD004 which returned 2.59m at 9.89 g/t Au including 1.49m at 15.26 g/t Au (see press release dated July 29, 2020). Other significant results include 23RDD187 with 8.95m at 6.34 g/t Au including 1.45m at 20.27 g/t Au, which remains open at depth.

Infill drilling along the R2 and R3 mineralised structures continued to intersect narrow high-grade mineralisation including 23RDD182 with 1.00m at 54.40 g/t Au, located 50m to the west of hole 21RDD088 which returned 1.77m at 117.86 g/t Au (see press release dated March 28, 2022) within the R2 vein system. Some of the highest grade mineralisation returned to date along the R3 structures were obtained during the 2023 fall infill drill program including 23RDD181 with 0.35m at 134.30 g/t Au, 23RDD178 with 0.40m at 62.10 g/t Au, and 23RDD183 returning 2.30m at 7.85 g/t Au including 0.53m at 30.50 g/t Au.

Two drill holes were designed to test the shallower portions of the Regnault diorite up dip from the 2023 winter discovery holes that intersected mineralisation down to 1,000m vertical depth including 23RDD172 which returned 2.56 g/t over 41.85m including 11.96 g/t Au over 4.45m (see press release dated August 8, 2023). These large step-outs (200-300m) returned narrow, moderate grade mineralisation within the R9, R10, and R11 shear zones including 23RDD174 which returned 3.70m at 2.14 g/t Au including 0.40m at 10.70 g/t Au, a 215m up dip step-out from 23RDD159 that returned 1.20m at 55.70 g/t Au (see press release dated May 31, 2023).

Figure 3. Core photo of R6 zone in hole 23RDD185: 19.25m at 19.95 g/t Au including 2.50m at 47.58 g/t Au and including 1.90m at 106.48 g/t Au

Kenorland Closes Exchange of 20% Joint Venture Interest in Frotet Project for 4.0% NSR Royalty

Kenorland is also pleased to announce that, further to its press release dated January 16, 2024, it has completed the exchange with Sumitomo of the Company’s 20% participating interest in the Frotet Project, located in Quebec, for a 4.0% net smelter return royalty (the “Frotet Royalty”) on all minerals extracted from the Project. As a result of the transaction, Sumitomo now owns 100% of the Project and the joint venture agreement dated April 17, 2018 between the Company and Sumitomo is now terminated.

As previously announced, the Frotet Royalty is subject to the following buy down rights in favour of Sumitomo:

- A 0.25% royalty interest may be purchased for a C$3,000,000 cash payment to the Company within five (5) years of the grant of the Frotet Royalty upon the closing of the transaction.

- A 0.50% royalty interest may be purchased for a C$10,000,000 cash payment to the Company within ten (10) years of the grant of the Frotet Royalty upon the closing of the transaction, provided Sumitomo has exercised the first buy down right.

In the event Sumitomo exercises the foregoing buy down rights, the Frotet Royalty would be reduced to an uncapped 3.25% net smelter return royalty on all minerals extracted from the Project.

Kenorland will remain the operator of the Project for at least one year following the transaction to facilitate a successful transition of operatorship to Sumitomo.

Exercise of Top-up Right with Sumitomo

The Company is also pleased to announce that further to its press release dated February 2, 2024, the Company and Sumitomo, have completed the exercise of Sumitomo’s ‘top-up right’ to retain its 10.1% interest in the Company as granted within the investor rights agreement dated November 5, 2021.

An aggregate of 67,409 common shares were issued for aggregate consideration of $51,878. The common shares issuable in the placement are subject to a statutory hold period in accordance with applicable securities legislation and the rules and policies of the TSXV expiring on June 10, 2024.

As Sumitomo is the beneficial owner of more than 10% of Kenorland’s outstanding shares, it is a “related party” to the Company within the meaning of Multilateral Instrument 61-101- Protection of Minority Security Holders in Special Transactions ("MI 61-101"). As such, both transactions constituted a "related party transaction" within the meaning of MI 61-101.

In both cases, the Company has relied upon on exemptions from formal valuation and the minority shareholder approval requirements of MI 61-101 found in sections 5.5(a) and 5.7(1)(a) of MI 61-101 as the fair market value of either transaction does not constitute more than the 25% of the Company’s market capitalization. In addition, in relation to the Frotet Royalty, the Company relied upon the exemptions found in 5.5(d) and 5.7(1)(c) of MI 61-101 as the transaction was a purchase or sale, in the ordinary course of the Company’s business under an agreement that was approved by the board of directors, the existence of which was generally disclosed.

Table 1. Table of assay results from the 2023 fall drill program

| HOLE ID |

From (m) |

To (m) |

Interval (m)† |

Au (g/t) |

Ag (g/t) |

Residual Au (g/t)‡ |

| 23RDD174 |

|

47.50 |

54.30 |

6.80 |

0.80 |

0.97 |

|

| And |

445.00 |

448.75 |

3.75 |

1.46 |

2.27 |

0.92 |

| Incl. |

447.00 |

447.65 |

0.65 |

4.03 |

7.20 |

|

| And |

719.85 |

723.50 |

3.65 |

1.78 |

2.04 |

1.53 |

| Incl. |

722.50 |

722.80 |

0.30 |

4.65 |

4.40 |

|

| And |

981.00 |

984.70 |

3.70 |

2.14 |

2.49 |

1.10 |

| Incl. |

982.00 |

982.40 |

0.40 |

10.70 |

14.10 |

|

| And |

1059.40 |

1069.25 |

9.85 |

1.35 |

1.40 |

1.21 |

| Incl. |

1062.80 |

1063.45 |

0.65 |

3.33 |

2.50 |

|

| 23RDD175 |

|

113.50 |

122.50 |

9.00 |

1.80 |

1.28 |

1.30 |

| Incl. |

114.50 |

115.50 |

1.00 |

5.78 |

5.10 |

|

| And |

374.70 |

382.50 |

7.80 |

1.54 |

1.36 |

1.13 |

| Incl. |

379.30 |

380.00 |

0.70 |

5.76 |

4.50 |

|

| And |

628.28 |

632.00 |

3.72 |

1.51 |

0.83 |

|

| And |

653.70 |

671.35 |

17.65 |

4.59 |

7.88 |

2.03 |

| Incl. |

669.52 |

670.60 |

1.08 |

43.96 |

103.15 |

|

| 23RDD176 |

|

378.80 |

383.50 |

4.70 |

1.12 |

1.38 |

|

| And |

555.00 |

565.70 |

10.70 |

5.67 |

7.98 |

3.52 |

| Incl. |

559.20 |

561.20 |

2.00 |

14.99 |

24.61 |

|

| 23RDD177 |

|

268.60 |

271.59 |

2.99 |

5.61 |

6.63 |

1.49 |

| Incl. |

269.04 |

269.52 |

0.48 |

27.20 |

31.40 |

|

| And |

281.00 |

282.00 |

1.00 |

174.54 |

262.92 |

1.07 |

| Incl. |

281.30 |

281.60 |

0.30 |

579.30 |

873.00 |

|

| And |

592.50 |

603.81 |

11.31 |

6.89 |

6.43 |

2.40 |

| Incl. |

593.44 |

595.56 |

2.12 |

26.37 |

24.05 |

|

| And |

623.42 |

627.00 |

3.58 |

1.89 |

3.09 |

1.08 |

| Incl. |

626.24 |

627.00 |

0.76 |

4.92 |

9.10 |

|

| 23RDD178 |

|

40.00 |

44.80 |

4.80 |

1.49 |

0.75 |

0.86 |

| Incl. |

40.00 |

40.30 |

0.30 |

10.90 |

5.10 |

|

| And |

265.50 |

268.20 |

2.70 |

3.60 |

8.76 |

0.87 |

| Incl. |

265.50 |

266.00 |

0.50 |

15.60 |

41.00 |

|

| And |

282.00 |

282.40 |

0.40 |

62.10 |

129.40 |

|

| 23RDD179 |

|

1024.30 |

1031.35 |

7.05 |

0.77 |

2.57 |

|

| And |

1119.00 |

1121.60 |

2.60 |

2.32 |

2.05 |

1.44 |

| Incl. |

1119.50 |

1120.00 |

0.50 |

5.98 |

4.90 |

|

| And |

1188.50 |

1189.80 |

1.30 |

4.62 |

2.86 |

|

| 23RDD180 |

|

40.70 |

41.67 |

0.97 |

8.49 |

11.11 |

|

| And |

218.10 |

221.30 |

3.20 |

5.31 |

5.86 |

1.75 |

| Incl. |

219.20 |

220.40 |

1.20 |

11.23 |

13.11 |

|

| 23RDD181 |

|

138.30 |

146.70 |

8.40 |

0.63 |

0.81 |

|

| And |

190.00 |

197.52 |

7.52 |

3.08 |

4.93 |

1.61 |

| Incl. |

194.80 |

195.25 |

0.45 |

26.30 |

48.80 |

|

| And |

282.60 |

282.95 |

0.35 |

134.30 |

153.40 |

|

| 23RDD182 |

|

17.20 |

18.20 |

1.00 |

54.40 |

8.20 |

|

| And |

32.85 |

35.45 |

2.60 |

9.91 |

10.08 |

2.56 |

| Incl. |

34.85 |

35.45 |

0.60 |

34.40 |

33.90 |

|

| And |

107.00 |

107.55 |

0.55 |

17.60 |

10.80 |

|

| And |

341.65 |

343.50 |

1.85 |

8.40 |

10.92 |

1.00 |

| Incl. |

341.65 |

342.00 |

0.35 |

40.10 |

51.30 |

|

| 23RDD183 |

|

49.80 |

53.80 |

4.00 |

4.00 |

6.98 |

2.13 |

| Incl. |

52.65 |

53.15 |

0.50 |

17.10 |

39.40 |

|

| And |

331.90 |

332.24 |

0.34 |

34.40 |

41.10 |

|

| And |

344.70 |

347.00 |

2.30 |

7.85 |

11.86 |

1.07 |

| Incl. |

345.55 |

346.08 |

0.53 |

30.50 |

46.10 |

|

| 23RDD184 |

|

284.75 |

286.25 |

1.50 |

4.24 |

4.11 |

1.08 |

| Incl. |

285.95 |

286.25 |

0.30 |

16.90 |

15.40 |

|

| 23RDD185 |

|

177.00 |

180.50 |

3.50 |

3.84 |

5.18 |

1.07 |

| Incl. |

177.50 |

178.25 |

0.75 |

14.00 |

19.90 |

|

| And |

207.50 |

209.00 |

1.50 |

3.58 |

1.00 |

|

| And |

297.80 |

301.10 |

3.30 |

3.60 |

3.48 |

1.43 |

| Incl. |

297.80 |

298.40 |

0.60 |

13.40 |

12.60 |

|

| And |

313.80 |

318.15 |

4.35 |

1.69 |

1.81 |

1.48 |

| Incl. |

315.40 |

315.80 |

0.40 |

3.72 |

3.20 |

|

| And |

358.30 |

358.60 |

0.30 |

40.20 |

17.10 |

|

| And |

384.90 |

389.25 |

4.35 |

1.39 |

1.84 |

|

| And |

461.25 |

480.50 |

19.25 |

19.95 |

15.44 |

4.22 |

| Incl. |

463.40 |

465.90 |

2.50 |

47.58 |

42.04 |

|

| And Incl. |

478.30 |

480.20 |

1.90 |

106.48 |

61.99 |

|

| And |

590.80 |

598.50 |

7.70 |

4.84 |

5.43 |

2.71 |

| Incl. |

597.25 |

598.00 |

0.75 |

24.60 |

32.10 |

|

| And |

818.00 |

827.70 |

9.70 |

0.81 |

0.68 |

|

| 23RDD186 |

|

337.00 |

339.30 |

2.30 |

2.81 |

2.09 |

|

| 23RDD187 |

|

74.00 |

75.10 |

1.10 |

4.67 |

1.60 |

|

| And |

297.00 |

300.20 |

3.20 |

2.25 |

1.65 |

1.25 |

| Incl. |

297.00 |

297.44 |

0.44 |

8.51 |

5.30 |

|

| And |

371.50 |

380.45 |

8.95 |

6.34 |

8.09 |

3.65 |

| Incl. |

372.00 |

373.45 |

1.45 |

20.27 |

9.79 |

|

| 23RDD188 |

|

58.80 |

59.85 |

1.05 |

5.81 |

1.21 |

|

| And |

198.70 |

213.00 |

14.30 |

0.88 |

0.45 |

|

| And |

259.30 |

260.10 |

0.80 |

9.78 |

5.40 |

|

| And |

381.50 |

387.10 |

5.60 |

1.71 |

1.55 |

1.35 |

| Incl. |

386.50 |

387.10 |

0.60 |

4.64 |

2.70 |

|

| And |

402.00 |

414.00 |

12.00 |

1.81 |

1.92 |

1.31 |

| Incl. |

402.00 |

402.50 |

0.50 |

13.30 |

21.10 |

|

| And |

634.00 |

639.30 |

5.30 |

1.67 |

1.88 |

1.36 |

| Incl. |

638.80 |

639.30 |

0.50 |

4.58 |

4.10 |

|

| And |

854.40 |

864.00 |

9.60 |

1.06 |

1.49 |

0.74 |

| Incl. |

854.40 |

855.00 |

0.60 |

5.83 |

9.60 |

|

| And |

873.00 |

876.40 |

3.40 |

2.72 |

3.11 |

1.08 |

| Incl. |

874.40 |

874.90 |

0.50 |

12.20 |

15.00 |

|

| 23RDD189 |

|

254.50 |

256.00 |

1.50 |

3.68 |

0.60 |

|

| And |

314.70 |

318.00 |

3.30 |

1.67 |

0.54 |

0.79 |

| Incl. |

314.70 |

315.00 |

0.30 |

10.50 |

2.10 |

|

| 23RDD190 |

|

316.50 |

326.20 |

9.70 |

0.75 |

0.44 |

|

| 23RDD191 |

|

35.50 |

39.00 |

3.50 |

1.60 |

1.05 |

|

| 23RDD192 |

|

347.50 |

355.50 |

8.00 |

0.74 |

0.45 |

|

| And |

415.00 |

417.20 |

2.20 |

17.45 |

10.83 |

4.65 |

| Incl. |

415.80 |

416.10 |

0.30 |

98.50 |

42.10 |

|

| And |

644.00 |

645.00 |

1.00 |

7.32 |

9.06 |

|

| And |

662.30 |

663.80 |

1.50 |

9.41 |

10.87 |

1.32 |

| Incl. |

662.80 |

663.30 |

0.50 |

25.60 |

28.40 |

|

| And |

824.80 |

828.10 |

3.30 |

2.85 |

2.70 |

1.42 |

| Incl. |

827.30 |

828.10 |

0.80 |

7.32 |

6.52 |

|

| 23RDD193 |

|

173.65 |

176.40 |

2.75 |

10.99 |

5.17 |

2.41 |

| Incl. |

174.80 |

176.03 |

1.23 |

21.59 |

9.86 |

|

| And |

255.15 |

290.60 |

35.45 |

2.90 |

1.60 |

1.60 |

| Incl. |

270.50 |

272.20 |

1.70 |

15.52 |

6.43 |

|

| And Incl. |

281.80 |

282.50 |

0.70 |

33.80 |

16.00 |

|

| And |

298.25 |

301.45 |

3.20 |

1.84 |

0.79 |

|

| And |

325.00 |

332.50 |

7.50 |

1.24 |

0.80 |

|

| And |

335.50 |

341.40 |

5.90 |

0.91 |

0.77 |

|

† Assay intervals reported are core lengths, true widths have not been determined

‡ Residual Au (g/t) represents the average grade of the drill hole interval excluding the highlighted internal interval

Table 2. Drill collar table of reported drill holes from the 2023 fall drill program

| Hole ID |

Easting (NAD83) |

Northing (NAD83) |

Elevation (m) |

Depth (m) |

Dip |

Azimuth |

| 23RDD174 |

519152 |

5620211 |

379 |

1149.00 |

-57 |

154 |

| 23RDD175 |

519232 |

5621016 |

377 |

735.00 |

-44 |

158 |

| 23RDD176 |

519232 |

5621016 |

377 |

771.00 |

-52 |

157 |

| 23RDD177 |

519191 |

5620916 |

376 |

852.00 |

-46 |

159 |

| 23RDD178 |

518654 |

5620002 |

378 |

342.00 |

-45 |

167 |

| 23RDD179 |

519553 |

5620158 |

380 |

1212.00 |

-63 |

161 |

| 23RDD180 |

518744 |

5619998 |

377 |

288.00 |

-44 |

170 |

| 23RDD181 |

518813 |

5620030 |

376 |

291.00 |

-45 |

164 |

| 23RDD182 |

518759 |

5620091 |

381 |

372.00 |

-45 |

167 |

| 23RDD183 |

518839 |

5620142 |

382 |

396.00 |

-45 |

162 |

| 23RDD184 |

518854 |

5620059 |

376 |

303.00 |

-44 |

158 |

| 23RDD185 |

519852 |

5621006 |

376 |

921.00 |

-61 |

162 |

| 23RDD186 |

519000 |

5620128 |

377 |

354.00 |

-54 |

154 |

| 23RDD187 |

520017 |

5621013 |

382 |

468.00 |

-47 |

330 |

| 23RDD188 |

519895 |

5621083 |

379 |

909.00 |

-63 |

159 |

| 23RDD189 |

520030 |

5621100 |

385 |

330.00 |

-47 |

335 |

| 23RDD190 |

520030 |

5621099 |

385 |

486.00 |

-64 |

338 |

| 23RDD191 |

519852 |

5621009 |

376 |

483.00 |

-47 |

324 |

| 23RDD192 |

519935 |

5621161 |

379 |

835.65 |

-63 |

161 |

| 23RDD193 |

519892 |

5621088 |

379 |

420.00 |

-50 |

320 |

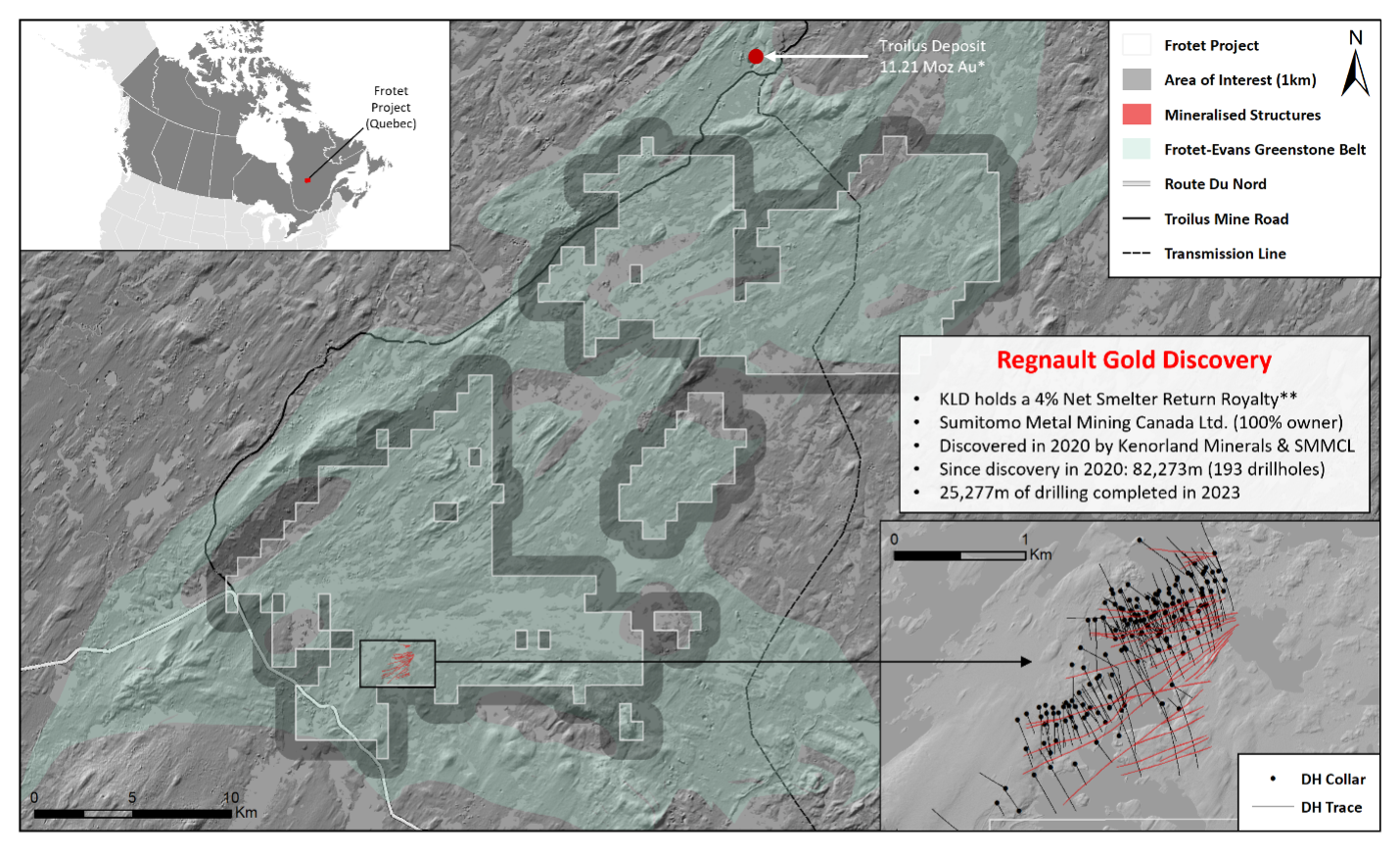

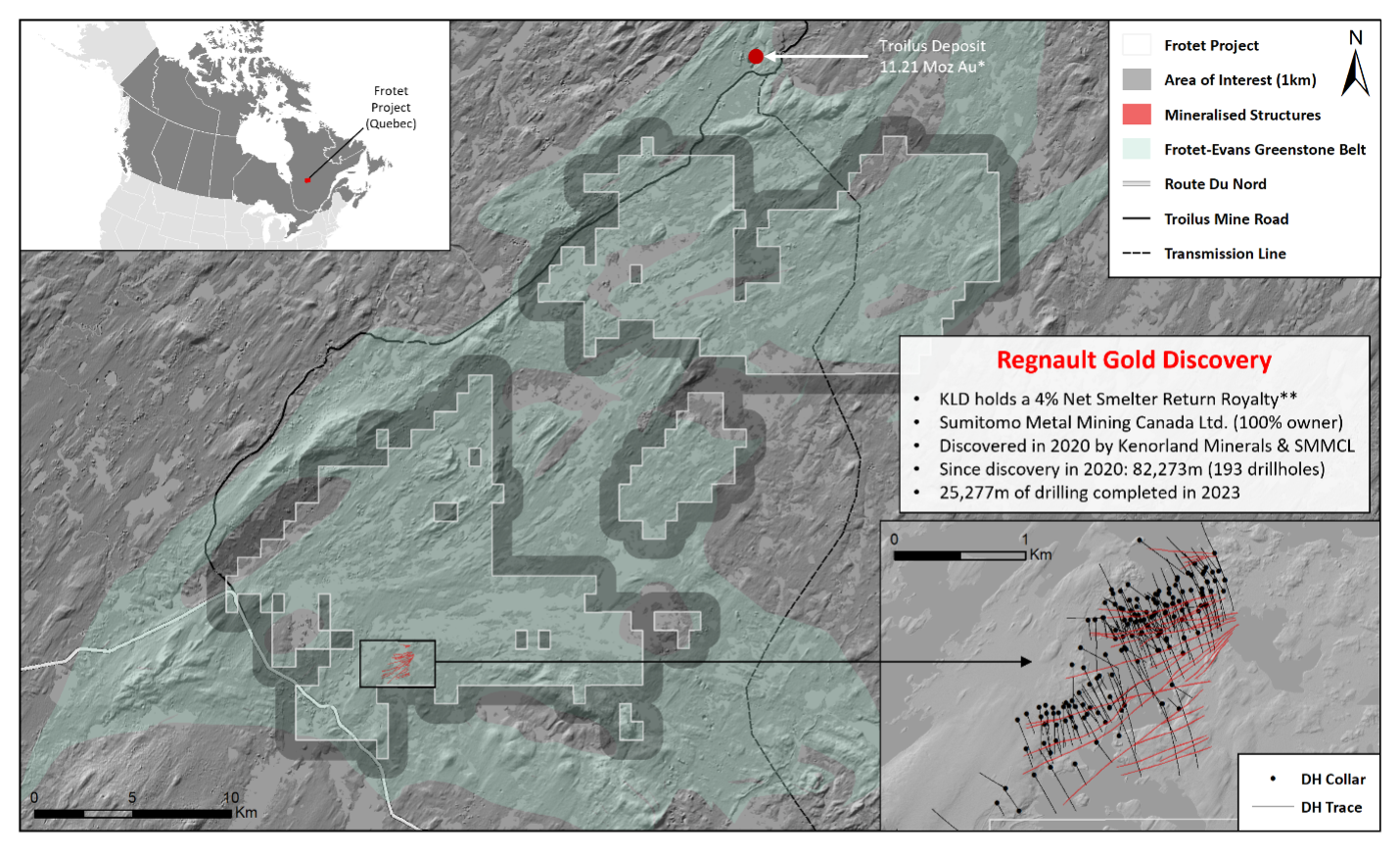

About the Frotet Project

The Project covers 39,365 hectares of the Frotet-Evans greenstone belt within the Opatica geological sub-province of Quebec. The property is adjacent to the past-producing Troilus Gold Corporation’s Au-Cu mine (9.23Moz Au indicated resource) and covers several major deformation zones associated with known orogenic gold prospects, as well as stratigraphy hosting VMS deposits elsewhere in the belt. Kenorland initially staked the Project in 2017 and then entered into a joint venture and earn-in agreement with Sumitomo in 2018.

The Project hosts the Regnault gold system, a greenfields discovery made by Kenorland and Sumitomo in 2020 following two years of systematic exploration. Since the initial discovery, Regnault has seen extensive exploration, totaling 82,273 meters of drilling (193 drillholes).

On January 16, 2024, Kenorland announced that it had entered into a transaction to exchange its 20% participating interest in the Frotet Joint Venture with Sumitomo Metal Mining, to a 4% NSR Royalty. Kenorland will remain the operator of the Project for a minimum of one year from the closing of the transaction.

On January 24, 2024, Kenorland announced a 17,600m winter drill program focusing on infill and step-out targets along the R1, R5, R6 and R7 mineralised structures, as well as broad step-outs along the R4 structures in towards the north, and R9, R10, and R11 structures within the southern portions of the deposit area.

The Project is located 100 kilometers to the north of Chibougamau, Quebec. Favorable infrastructure exists in the Project area with an extensive forestry road network as well as the Route-du-Nord crossing the southwestern portion of the property. A power transmission line also crosses through the property which supplied power to the past producing Troilus mine.

Figure 4. Map of the Frotet Project and Royalty

*Technical Report and Mineral Resource Estimate on the Troilus Gold-Copper Project, Mineral Resources Effective Date: 02 October 2023

**The Frotet Royalty is subject to the following buy down rights in favour of Sumitomo:

A 0.25% royalty interest may be purchased for a C$3,000,000 cash payment to Kenorland within five (5) years of the grant of the Frotet Royalty

A 0.50% royalty interest may be purchased for a C$10,000,000 cash payment to Kenorland within ten (10) years of the grant of the Frotet Royalty

In the event Sumitomo exercises the foregoing buy down rights, the Frotet Royalty would be reduced to an uncapped 3.25% net smelter return royalty on all minerals extracted from the Project

QA/QC and Core Sampling Protocols

All drill core samples were collected under the supervision of Kenorland employees. Drill core was transported from the drill platform to the logging facility where it was logged, photographed, and split by diamond saw prior to being sampled. Samples were then bagged, and blanks and certified reference materials were inserted at regular intervals. Groups of samples were placed in large bags, sealed with numbered tags in order to maintain a chain-of-custody, and transported from Chibougamau to Bureau Veritas Commodities (“BV”) laboratory in Timmins, Ontario.

Sample preparation and analytical work for this drill program were carried out by BV. Samples were prepared for analysis according to BV method PRP70-250: individual samples were crushed to 2mm (10 mesh) and a 250g split was pulverized to 75μm (200 mesh) for analysis and then assayed for gold. Gold in samples were analyzed using BV method FA430 where a 30g split is analyzed with fire assay by Pb collection and AAS finish. Over-limits gold samples were re-analyzed using BV method FA530 where a 30g split is analyzed with fire assay by Pb collection and gravimetric finish. Multi-element geochemical analysis (45 elements) was performed on all samples using BV method MA200 where a 0.25g split is by multi-acid digest with ICP-MS/ES finish. All results passed the QA/QC screening at the lab, all company inserted standards and blanks returned results that were within acceptable limits.

Qualified Person

Cédric Mayer, M.Sc., P.Geo. (OGQ #02385), “Qualified Person” under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

About Kenorland Minerals

Kenorland Minerals Ltd. (TSX.V KLD) is a well-financed mineral exploration company focussed on project generation and early-stage exploration in North America. Kenorland’s exploration strategy is to advance greenfields projects through systematic, property-wide, phased exploration surveys financed primarily through exploration partnerships including option to joint venture agreements. Kenorland holds a 4% net smelter return royalty on the Frotet Project in Quebec which is owned by Sumitomo Metal Mining Canada Ltd. The Frotet Project hosts the Regnault gold system, a greenfields discovery made by Kenorland and Sumitomo Metal Mining Canada Ltd. in 2020. Kenorland is based in Vancouver, British Columbia, Canada.

Further information can be found on the Company’s website www.kenorlandminerals.com

On behalf of the Board of Directors,

Zach Flood

President, CEO & Director

For further information, please contact:

Alex Muir, CFA

Investor Relations Manager

Tel +1 604 568 6005

info@kenorlandminerals.com

Cautionary Statement Regarding Forward Looking Statements

This news release contains forward-looking statements and forward-looking information (together, "forward-looking statements") within the meaning of applicable securities laws. All statements, other than statements of historical facts, are forward-looking statements. Generally, forward-looking statements can be identified by the use of terminology such as "plans", "expects', "estimates", "intends", "anticipates", "believes" or variations of such words, or statements that certain actions, events or results "may", "could", "would", "might", "will be taken", "occur" or "be achieved". Forward looking statements involve risks, uncertainties and other factors disclosed under the heading “Risk Factors” and elsewhere in the Company’s filings with Canadian securities regulators, that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking statements. Although the Company believes that the assumptions and factors used in preparing these forward-looking statements are reasonable based upon the information currently available to management as of the date hereof, actual results and developments may differ materially from those contemplated by these statements. Readers are therefore cautioned not to place undue reliance on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed times frames or at all. Except where required by applicable law, the Company disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.